why did i get a tax levy

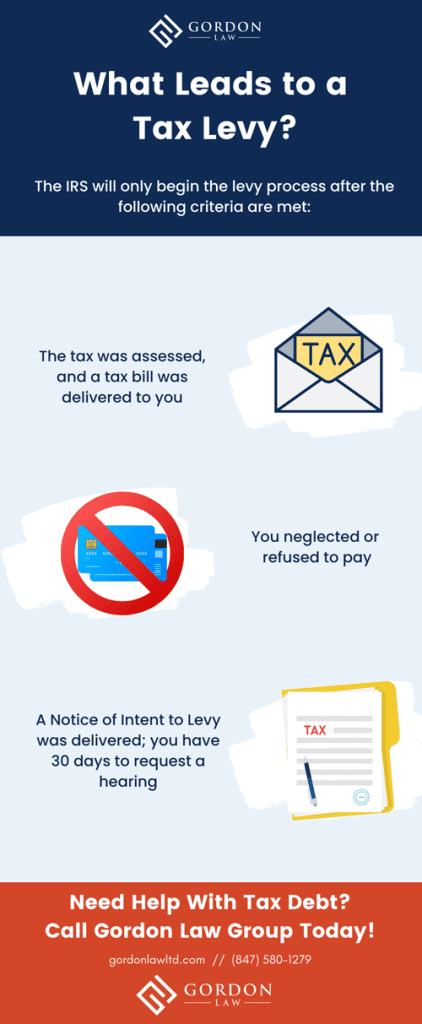

When your assets have no monetary value you may prove to the IRS that. The IRS assessed the tax and sent you a Notice and Demand for Payment a tax bill.

What Is A State Tax Levy State Income Tax Levy Program

It can garnish wages take money in your bank or other financial account seize and sell your vehicles real estate.

. Working With a Tax Professional Attempting to negotiate on your own with the. The Medicare levy is 2 of your taxable income in addition to the. The bank levy lasts until the debt.

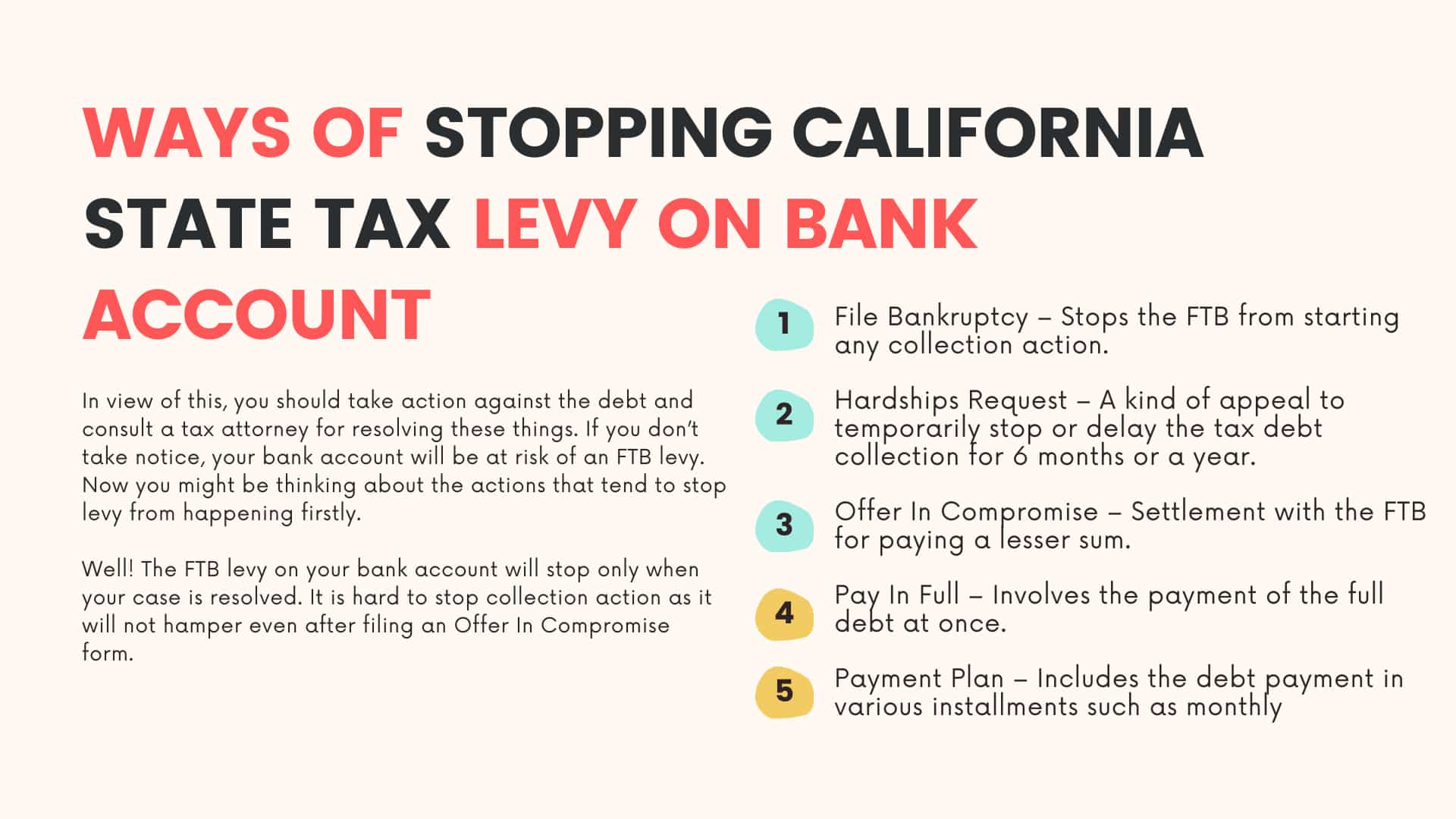

Under the Municipal Tax Levy Program MTLP we may levy your citymunicipal tax refund to collect the federal tax liabilities you owe. A qualified tax attorney can halt the bank levy process and help you obtain a fair and affordable tax settlement. Get information on property taxes including paying property taxes and property tax relief programs.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. Its their last resort for collecting money. The Medicare levy helps fund some of the costs of Australias public health system known as Medicare.

An IRS levy permits the. The reason the IRS uses levies is to liquidate your assets to satisfy your tax debt. A tax levy is when the irs takes property or assets to cover an outstanding tax bill.

Why did I get a tax levy. The IRS can garnish wages take money from your bank account seize your property. You neglected or refused.

If you receive an IRS. What Is a IRS Tax Levy. A levy isnt just put on you for fun though it happens.

Make the Internal Revenue Service an offer they cant refuse. A tax levy is when the IRS issues a notice of levy to a third party who is responsible for that particular property. If you get approved for an offer in compromise tax settlement you.

A tax levy is the seizure of property to pay taxes owed. You will not receive a bank levy until after the irs has sent you a series. Property Tax Information Search for real and personal property tax records find out.

You will not receive a bank levy until after the irs has sent you a series of. Currently this program only applies to. A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes.

A levy allows a creditor debt collector or government tax agency to freely withdraw funds from a persons checking account for an unpaid debt. The IRS can put a tax lien on your property if you neglect or refuse to fully pay a delinquent tax debt. Tax relief from back taxes or unfiled income tax return tip 4.

You paid the amount you owe The period for collection ended prior to the levy being issued Releasing the levy will help. The IRS is required to release a levy if it determines that. A tax lien doesnt force you to sell property in.

Why Did I Get A Tax Levy. The IRS uses the levy forms described below. The most common reason above all others is due to unpaid taxes this is what they will be levying from your bank account.

A tax lien is a claim the. The tax levy can be placed on your bank accounts wages social security investment. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

Regardless of the IRS form used a levy attaches to property or rights to property you hold that belongs to the person levied against. Tax levies typically show up after the government has placed a tax lien. The IRS will usually levy only after these four requirements are met.

Why Did I Get A Tax Levy. Why did I get a tax levy. A tax levy is when the irs takes property or assets to cover an outstanding tax bill.

Irs Tax Levy What Is It And How Can You Stop It Gordon Law Group

Irs Tax Levy What Is It And How Can You Stop It Gordon Law Group

Operating Levy Alexander Local Schools

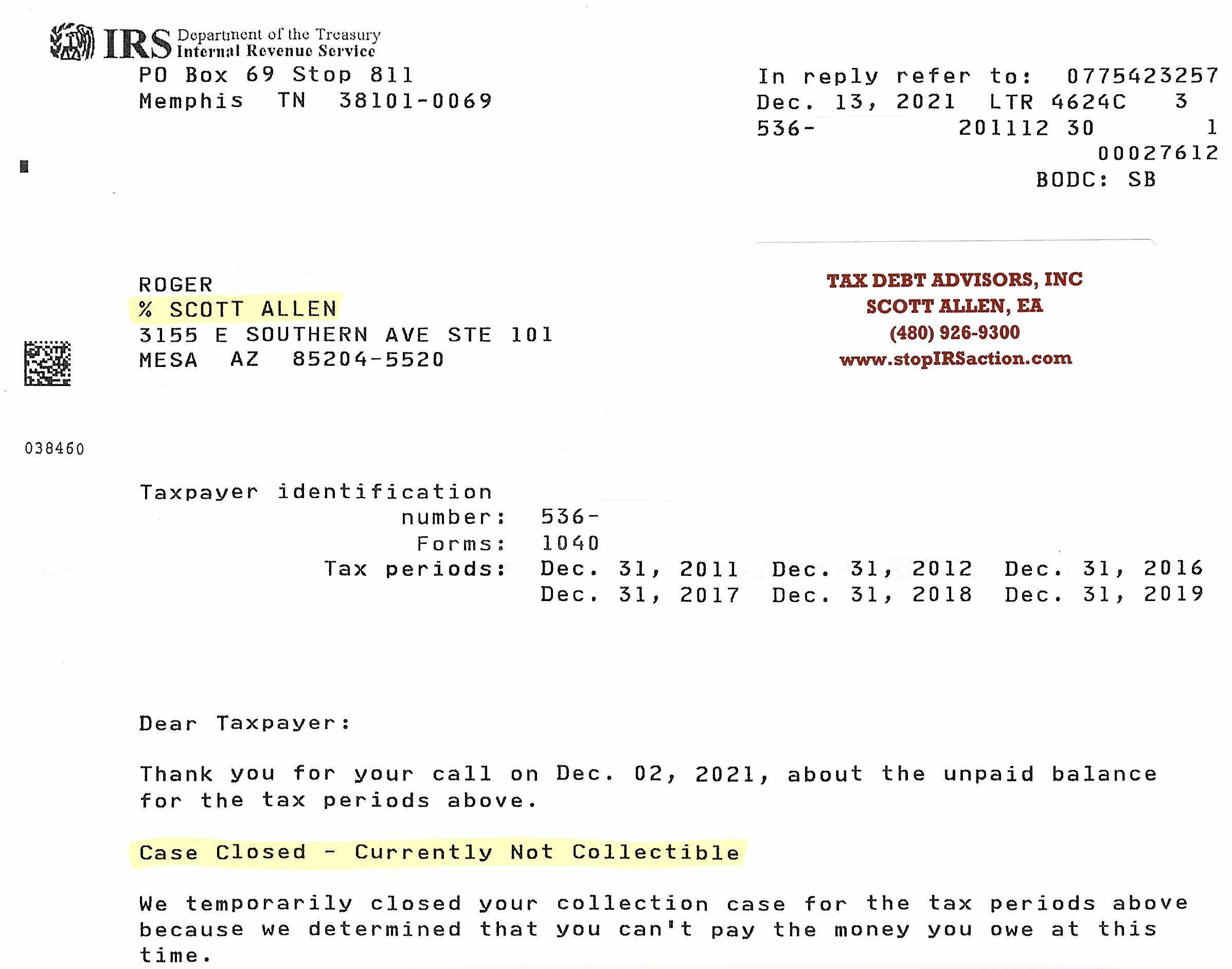

What Is A Levy How To Get It Released Tax Debt Advisors

Tax Levy What Is A Tax Levy And How To Stop One Community Tax

What Is A Tax Levy And Tax Lien Turbotax Tax Tips Videos

Wage Garnishment What The Irs Has To Do Before They Take Your Money

What Does Levy Taxes Mean Tax Levy Irs Omni Tax Solutions

Tax Levy Information City Of Glenwood

Tax Levy Understanding The Tax Levy A 15 Minute Guide

How To Stop Irs Wage Garnishment For Unpaid Tax Debts

Irs Tax Levy What Is It And How Can You Stop It Gordon Law Group

3 Proven Ways To Stop California State Tax Levy On Bank Account

Irs Levy On Business Bank Account What To Do When Business Levied

Irs Collections How To Avoid A Tax Lien Or Tax Levy Landmark Tax Group

Irs And State Bank Levy Information Larson Tax Relief

What Is The Difference Between A Tax Lien And A Tax Levy

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block